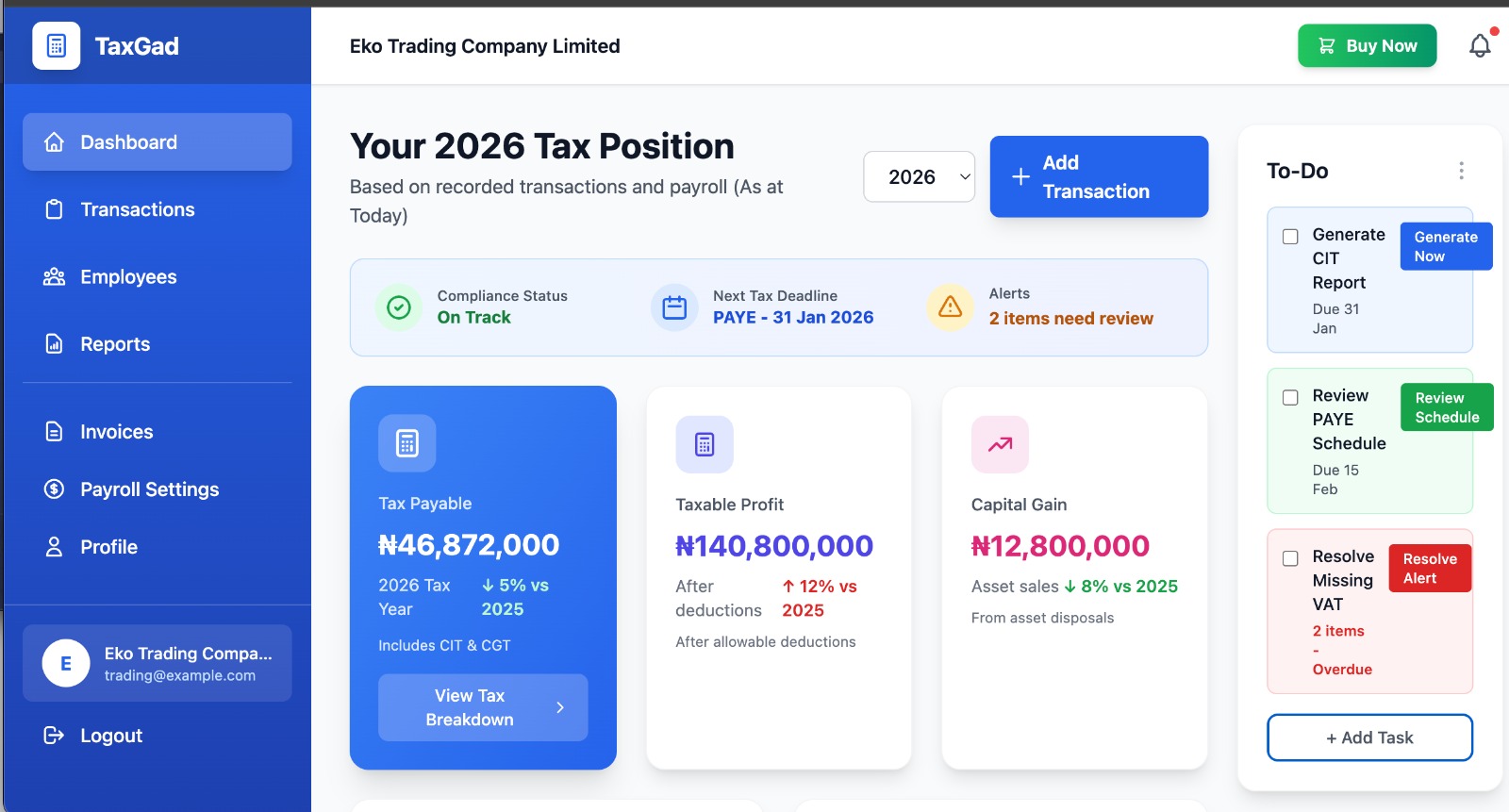

Manage income, expenses, invoice, payroll, PAYE, VAT, WHT, assets, and tax obligations with a system designed exactly how Nigerian tax authorities expect records.

Built in Nigeria • 2026 tax-law ready • For freelancers, SMEs & companies

Built in Nigeria • 2026 tax-law ready • For freelancers, SMEs & companies

Track multiple income streams, expenses, and more.

Maintain clean records, and now your tax exposure flattement.

Manage payroll, PAYE, WHT & assets salarienares.

Income and expenses classified correctly for the tax detail.

Employee salary records and monthly PAYE computation.

Real-time insight into PIT, CIT, VAT and WHT exp.

Proper treatment of asset disposals under 2026 CIT rules.

Real-sme reports for accountants and tax authorities.

Built for Nigerian law — not adapted foreign software.

Create professional invoices with automatic VAT & WHT calculations, track payments, and generate income transactions.

Download tax computation reports, invoices, and PAYE schedules as professional PDFs for filing and record-keeping.

Create and send professional invoices with automatic VAT and WHT calculations. Track payment status and automatically generate income transactions when invoices are paid.

TaxGad helps business owners see tax clearly before it becomes a problem. It reduces guesswork, spreadsheet chaos, and panic during filing season.

Generate and download professional PDF reports for tax computations, invoices, VAT returns, CIT estimates, and PAYE schedules. Perfect for filing and sharing with accountants.

Request a demo or speak with us about using TaxGad for your business.

Contact Gadnova